Why Venture Capital Firms Should Require Portfolio Companies to Use Contract Management Software

June 5th, 2023

In Q3 2022, the global venture capital dollar volume plummeted 53% year-over-year totals, dropping from $170 billion to $81 billion. As investors develop strategies to recoup losses and navigate an economic landscape of continued uncertainty, firms are weeding unnecessary risk out of their portfolios, emphasizing accountability and manageability in investments. For many venture capital firms, contract management is a critical component in de-risking investments and partnerships.

This guide explores why venture capital firms should incorporate the use of contract management software into their requirements for portfolio companies.

Key Takeaways

- Venture capital investing has declined over the last few years, prompting firms to develop new investment strategies focused on risk mitigation and transparency.

- Contract management software allows portfolio companies to provide their venture capital investors with critical reporting data.

- Implementing a comprehensive contract management software platform enables portfolio companies to manage contracts efficiently, transparently, and with scalability.

😉 Bonus: Check out our 10 Best Practices for Successful Contract Management.

6 Reasons for Venture Capital Firms to Require Contract Management Software

Venture capital firms should require their portfolio companies to use contract management software for several reasons.

1. Streamlined Contract Processes

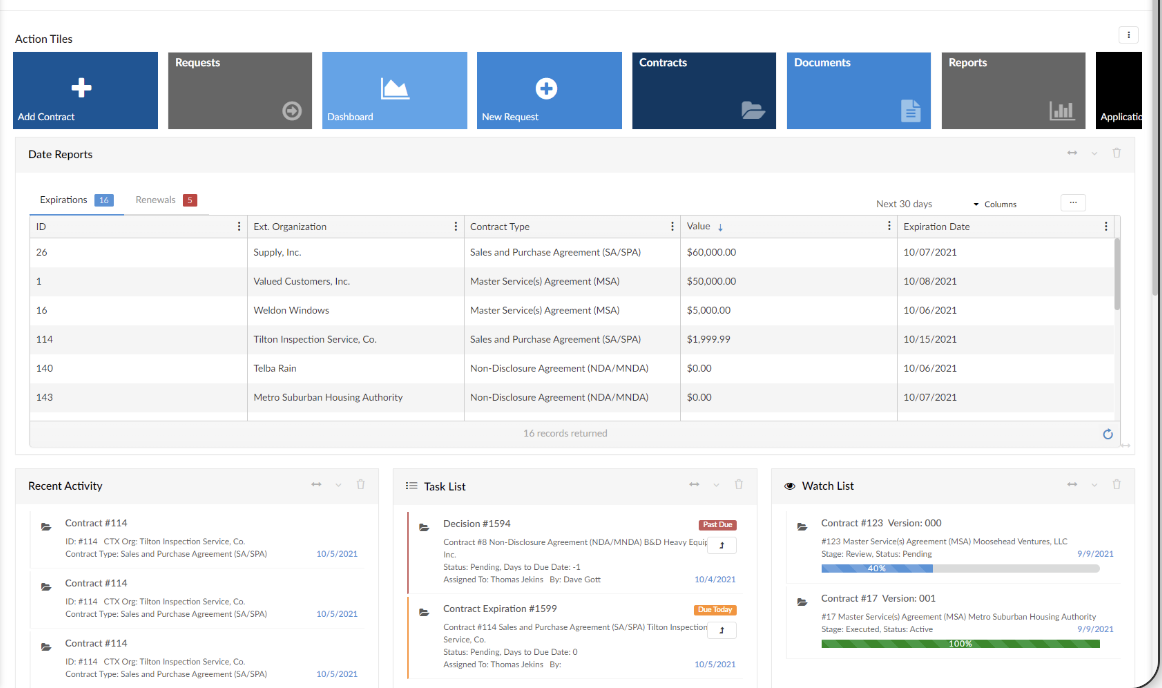

Contract management software helps streamline and automate the entire contract lifecycle, from drafting and negotiation to execution and renewal. It allows portfolio companies to manage their contracts efficiently, reduce manual errors, and improve overall productivity.

Processing bottlenecks and error correction delays raise the overall cost of contracting with portfolio companies and chip away at ROI. Stipulating upfront that investment recipients handle the contracting process with contract management software ensures that contracts process to finalization quickly and with minimal expense.

2. Risk Mitigation

Portfolio companies can use contract management software to mitigate potential risks, maintain compliance with contractual obligations, and reduce the likelihood of legal disputes or financial penalties. The features that enable these benefits are:

- Centralized contract repository: Having contracts in a single, digital location makes it easier for all obligated parties to track and monitor negotiations, revisions, and key dates. At the same time, a secure repository reduces the risk of data breaches – costing organizations an average of $4.35 million apiece in 2022 – through vulnerable communication channels such as email attachments.

- Contract templates: Large contracts often involve inputs from numerous parties across various organizations. Without shared standards, inconsistencies rapidly accumulate. Templates ensure all parties draft their portions in standardized formats adhering to agreed best practices.

- Workflows: Downtime between tasks completed by different people or departments can cause costly delays in contract processes. Automated workflows that route contracts to the next contributor or reviewer greatly reduce unnecessary downtime.

3. Enhanced Visibility and Control

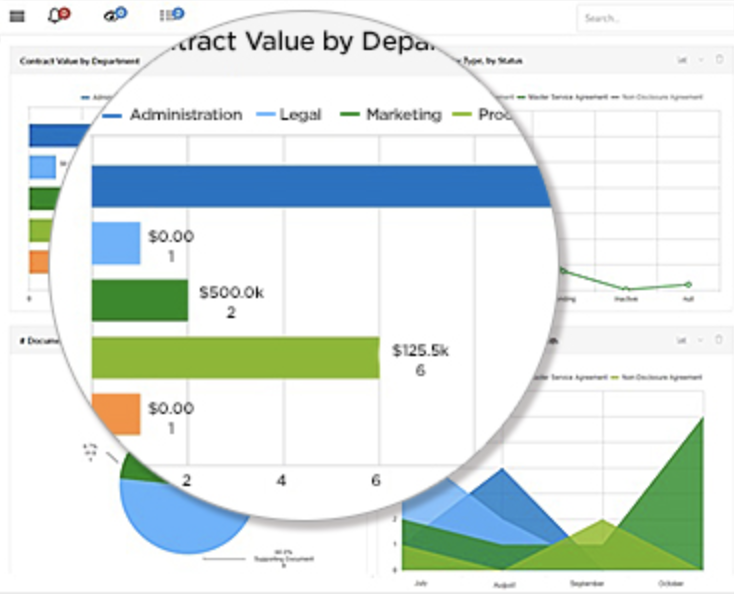

Contract management software provides real-time visibility into contract status and progress, providing venture capital firms with a comprehensive view of their portfolio companies’ contractual relationships and obligations. In a risk-averse environment, investors face increased pressure to maintain transparency and have data-backed KPIs on hand for evaluation.

Contract management software aggregates all contract KPI data in a single system. With real-time access to comprehensive data across their complete portfolios, firms can track performance trends in granular detail and often anticipate complications before they arise. Additionally, potential investment recipients who already use contract management software can use their own data to demonstrate investment viability with contract KPI records such as:

- Average time in contract lifecycle

- Average time to milestone executions

- Number of missed contract milestones

- Frequency of deviation from pre-approved clauses and language

- Rate of renewal failures

4. Efficient Due Diligence

Due diligence processes for new portfolio companies can easily delay approvals and rack up costly overages in legal hours if the parties responsible for oversight cannot efficiently search contracts and related documents. Creating and storing all contract documentation in contract management software eliminates this potential bottleneck.

With contract management software, reviewers can quickly search a portfolio company’s account for:

- Key contract terms

- Deviations from approved language

- Separate documents for comparison

5. Scalability and Growth

As portfolio companies grow, so do the volume and complexity of their contracts. Contract management software can handle larger contract portfolios, scale with the company’s needs, and accommodate more sophisticated contract requirements. This scalability allows venture capital firms and their portfolio partners to effectively manage expanding contract obligations while supporting growth objectives.

With scalability that keeps the contract management workload from ballooning as companies grow, contract management software:

- Saves valuable time and resources that organizations would otherwise spend manually sifting through piles of paperwork or digital documents

- Helps portfolio companies maintain regulatory compliance across multiple jurisdictions

- Allows portfolio companies to focus on their core business activities

6. Investor Reporting and Transparency

Venture capital firms have a fiduciary responsibility to their investors, making accurate reporting on the performance and financial health of portfolio companies essential. Contract management software can greatly facilitate investor reporting and ensure compliance with reporting requirements.

Investors in venture capital funds expect transparency and timely updates on the progress of their investments. Contract management software equips portfolio companies with the tools to generate comprehensive reports on contract performance and key financial obligations. Important metrics in these reports include:

- Contract value

- Revenue recognition

- Payment terms

- Upcoming milestones

With contract management software, portfolio companies can provide accurate and up-to-date information to their venture capital investors, enhancing trust and transparency. Sophisticated reporting capabilities enable venture capital firms to monitor the performance of their portfolio companies and make data-driven decisions regarding additional funding, strategic initiatives, and periodic portfolio adjustments.

Streamline Contract Management with Contract Logix

Keeping track of key contract KPIs for timely reporting can be daunting for startups and rapidly growing companies. Having comprehensive contract management capabilities in a single platform gives businesses the tools to meet contractual obligations and deliver timely investor reporting.

Contract Logix consolidates all contract data in a central repository with features for customized workflows, process automation, and AI-enabled data extraction.

Request a demo of Contract Logix today to learn more.

Looking for more contract management insights? Check out our latest blog post on “6 Steps to Streamline Your Contract Management Process“.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence