8 Steps to Effective Contract Management for Insurance Companies

January 11th, 2023

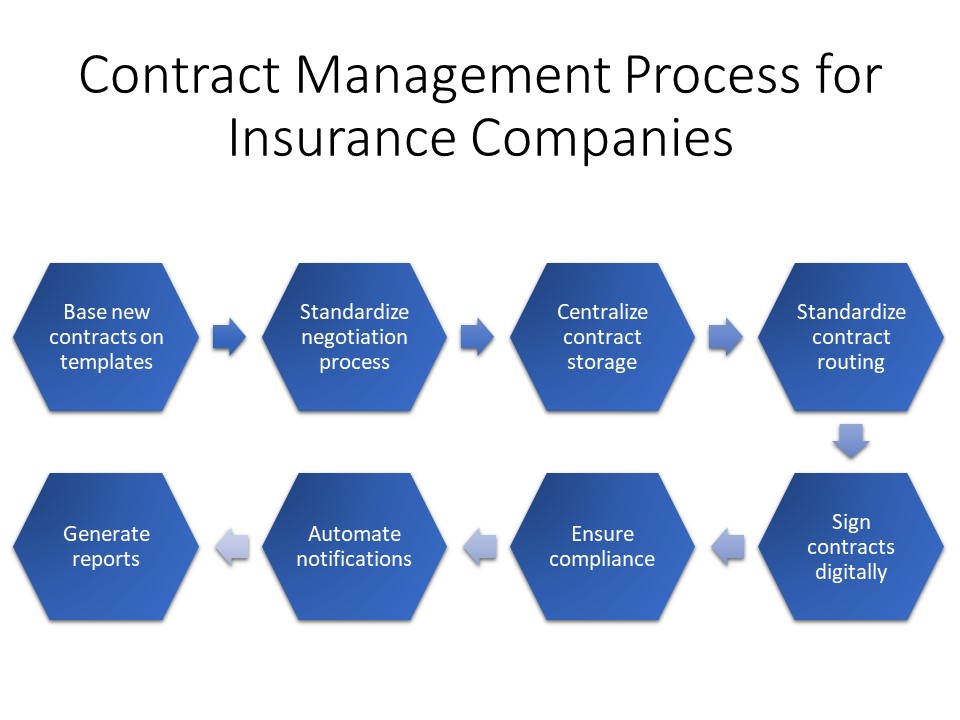

Insurance companies handle a lot of contracts. If you don’t manage those contracts effectively and efficiently, you’re likely to get overwhelmed, lose important work, and incur unnecessary risk. To ensure effective contract management, you need to follow eight simple steps – all of which you can accomplish with automated contract management software.

Key Takeaways

- Effective contract management for insurance companies can improve efficiency, minimize risk, and reduce errors

- To improve contract management, use pre-approved contract templates and clauses, standardize negotiations and routing, and employ e-signatures

- Insurance companies also need to centralize contract storage, ensure contract compliance, automate notifications, and generate detailed reports

Contract Management for Insurance Companies in Eight Easy Steps

Some insurance companies try to manage their multitude of contracts the old-fashioned way – by hand. Others embrace sophisticated contract management software. However you handle your contracts, you need to follow eight important steps to ensure your contracts get signed promptly, stored securely, and executed on schedule.

Step #1: Base All New Contracts on Templates

The first step in an insurance company’s contract management process is to initiate a new contract. This should not be a major challenge, especially if you base all your new contracts on existing ones. Instead of reinventing each new contract, use a preapproved contract template that contains standardized language and agreed-upon clauses and terms. This way, all your contracts will adhere to the standards your firm sets.

Step #2: Standardize the Negotiation Process

The key to effective contract management for insurance companies is to standardize as much of the process as possible. This includes the negotiation process. Standardizing negotiations – including specific terms and conditions – makes it easy for all approved personnel in your office to conduct rudimentary negotiations without senior management’s involvement. Make it clear which terms are acceptable and which aren’t, and your staff will be able to get more done in less time.

Step #3: Centralize Contract Storage

If you have multiple offices, chances are you have contracts stored in each one. Even in a single location, you may have paper contracts stored in multiple file cabinets, making it difficult to locate specific contracts for specific clients. It’s not surprising that 90% of professionals say they have trouble finding contracts when they need them.

A much better approach is to centralize all your contracts in a single location. If you still use paper contracts, that means a centralized physical location. If you’ve switched to electronic contracts, that means a centralized digital repository that all authorized employees at all your branches can access.

Step #4: Standardize Contract Routing

Many contracts get lost routing from one employee to another. Even more, contracts get slowed down in the routing process, especially with physical contracts. To speed up contract routing and minimize lost documents, standardize the routing process. Make sure the right people see the right contracts at the right time – and know what to do with them and by what date.

Step #5: Sign All Contracts Digitally

Another way to speed up contract routing is to digitize the signing process. Using e-signatures instead of requiring physical signatures can dramatically speed up contract execution. Unlike physical signatures where you may have to wait days, contracts with e-signatures get signed within 37 minutes of presentation.

Step #6: Ensure Compliance

Standardizing insurance contract practices also helps improve contract compliance. Ensure that all your contracts comply with:

- Your company standards

- Insurance industry regulations

- Governmental regulations

Step #7: Automate Notifications

You also need to ensure you and your clients are compliant with the terms of each contract. That means you have to deliver as written in the contract and ensure your clients deliver on their promises as well. The best way to ensure contract compliance is to receive automated notifications of when deliverables are due – a common feature of contract management software.

Step #8: Generate Reports

The final step in effective insurance contract management is keeping tabs on everything to which you’ve contractually committed. You need to know how many contracts you’ve signed in a given period, how many contracts are still in-process, when deliverables are due, and when contracts are due to expire (so you either let them expire or renegotiate them).

Generating this information is next to impossible with physical contracts, but this is part and parcel of an automated contract management solution. The more information you have, the more insightful analysis you can make.

Why Insurance Companies Need Contract Management Software

The easiest and most effective way to follow these eight steps is to use automated contract management software. With insurance contract management software, such as that offered by Contract Logix, you can speed up the contract process, reduce contract risk, and improve your firm’s performance.

Common benefits of contract management software for insurance companies include:

- Template and clause library. Standardize contract language and reduce risk by basing all new contracts on pre-approved templates and choosing acceptable terms and clauses from a clause and template library.

- Streamlined reviews and approvals. Automating the routing and approval process ensures that contracts always go to the right stakeholders and never get lost. Providing approval is as easy as checking a box on a computer screen.

- E-signature integration. Electronic contracts can be signed electronically, reducing wastage and speeding up execution.

- Central contract repository. All electronic contracts are stored in a centralized digital repository, either on-premises or in the cloud. Cloud-based storage is more scalable, secure, and more accessible for remote employees.

- Improved contract security. A single centralized contract repository is easier to secure than contracts stored in multiple silos. Limit access to authorized users and employ zero-trust access to minimize the number of employees with access to any given contract.

- Reduced contract risk. Keeping close track of all your contracts throughout the entire process can substantially reduce contract risk and contract fraud.

- Automated notifications. Contract management solutions automatically send out email or SMS notifications when deliverables are due and when contracts are due to expire, so you’ll never miss another deadline.

Reporting and analysis. Every contract interaction is automatically recorded, as is all contact content, making it easy to generate detailed reports and actionable analyses.

Choose Contract Logix for Effective Contract Management for Insurance

Contract Logix’s contract lifecycle management (CLM) solution is ideal for insurance companies. The software automates the entire contract management process from inception through execution and beyond. You get improved efficiency, fewer errors, and lower costs. It’s the smart and secure way to manage all your insurance contracts.

Contact Contract Logix to learn more about contract management for insurance companies.

Looking for more articles about Contract Management? Check out our previous article “Effective Contract Creation Process: The Complete Guide“.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence