How and Why to Create an Indemnification Agreement

Any contract you enter into carries some degree of risk. An indemnification agreement can help protect you from liability if the other party is negligent or breaches the contract.

When should you create indemnification agreements for your contracts—and how do you do so? Drafted properly, an indemnification agreement can mitigate an otherwise risky contract.

Key Takeaways

- An indemnification agreement can protect you from liability if the other party to a contract is negligent

- Any contracts involving high-risk or dangerous activities or equipment should include indemnification clauses

- The indemnitee is the party that wants protection; the indemnitor is the party that agrees not to hold the other party liable

- All indemnification agreements should specify the governing jurisdiction, scope of coverage, exceptions, and indemnification details

Why Are Contracts Risky?

Every contract you enter into is risky. There’s the risk that the other party won’t deliver as agreed upon. There’s the risk that you won’t meet scheduled deadlines. There’s the risk that the contract terms aren’t compliant with industry regulations or local laws. There’s even the risk that something unexpected will come up to compromise the contract or harm your business.

According to KPMG, these and other risks can reduce contract value by up to 9%. Fortunately, you can protect against unexpected risks by insisting on an indemnification agreement.

What Is an Indemnification Agreement?

Indemnification agreements go by many monikers—waivers of liability, release of liability, hold harmless agreements, no-fault agreements, and indemnity agreements. Whatever you call them, indemnification agreements are a necessary component of many contract negotiations today.

Put simply, an indemnification agreement stipulates that if something goes wrong in the execution of a contract, you won’t be held liable. It dramatically reduces the risk associated with many types of contracts.

The terms of an indemnification agreement ensure that you are not held liable for any contract-related loss or damage outside of your control. If the other party does something that harms or damages itself or any other party, neither can sue you for damages. You’re protected from what the other party might deliberately or inadvertently do.

For example, most car rental companies require customers to sign indemnity agreements when renting a car. The customer agrees to hold the rental company harmless for any loss or damage resulting from their use of the car. Thanks to the indemnification agreement, if the customer crashes the rental car into another vehicle, neither the customer nor the owner of the other vehicle can hold the car rental company liable for damages.

Indemnification agreements can cover either express or implied indemnity, as follows:

- Express indemnity details specific terms and conditions that both parties must follow

- Implied indemnity doesn’t detail specific conditions but instead holds both parties to a reasonableness standard

An indemnification agreement can be a clause in a larger contract between two parties or a separate agreement.

SOURCE: Elizabeth Potts Weinstein via YouTube

Why Might You Need an Indemnification Agreement?

When should you enter into an indemnification agreement with a contractual partner? Not all contracts require indemnification, but some carry high enough stakes—or large enough risks—to warrant indemnification.

In general, you should insist on an indemnification agreement when contracted activities carry a not insubstantial degree of risk. These activities might include:

- Providing products or services that could be dangerous

- Allowing high-risk activities on your business property

- Allowing the contracted party to use equipment belonging to your business

Following these guidelines, indemnification agreements are common in certain businesses, including construction, property and equipment rental, amusement parks, pet kennels, and fitness facilities.

How Do You Create an Indemnification Agreement?

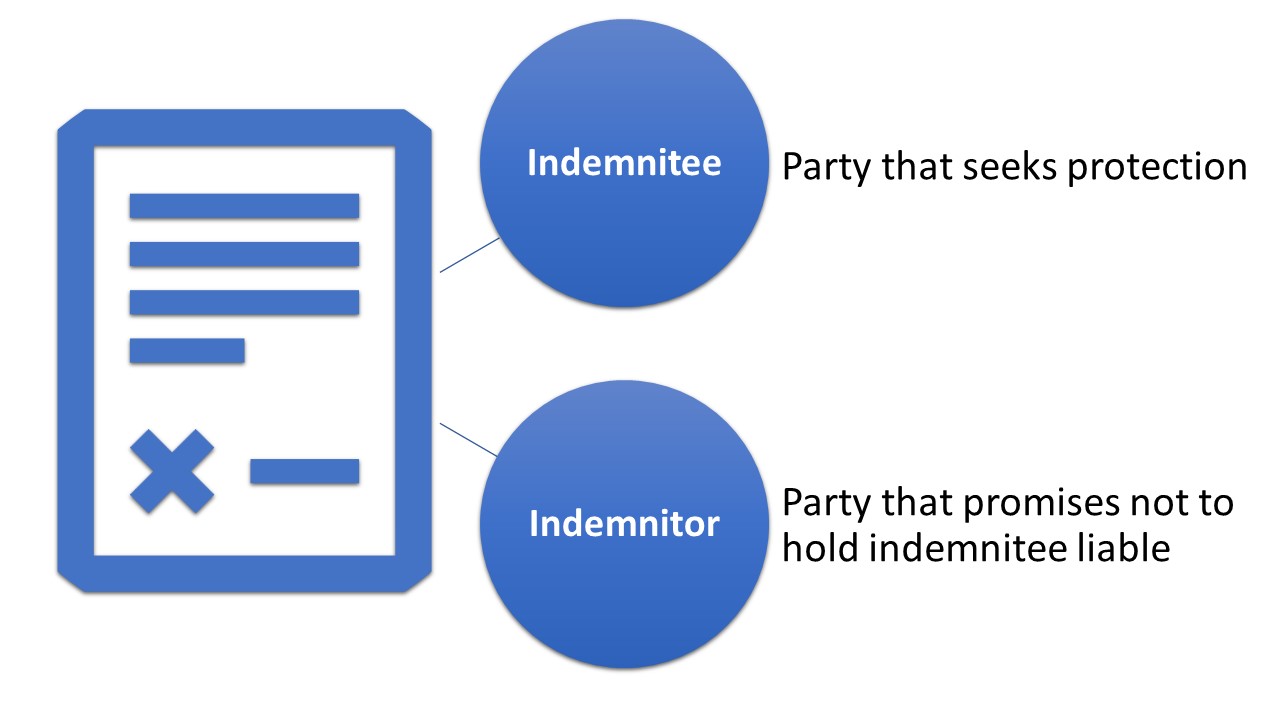

There are two parties to any indemnification agreement:

- The indemnitee is the party that wants protection

- The indemnitor or indemnifier is the party that promises not to hold the indemnitee liable

How you approach an indemnification agreement depends on your role. If you’re an indemnitee, you want an agreement that protects your company as much as is legally possible. If you’re an indemnitor, you want an agreement that limits your liability as much as possible, hopefully only for breach of contract and legally negligent acts. Negotiations often ensue over such details.

Whether you’re the indemnitee or indemnitor, the indemnification agreement you negotiate should include several key terms. We’ll discuss those in more detail.

Named Parties and Contractual Relationship

The indemnification agreement should start by naming the two parties (indemnitee and indemnitor). If it is a separate agreement—not a clause within a larger contract—it should reference the contract to which this agreement applies.

Governing Law and Jurisdiction

In the United States, indemnity laws vary from state to state. For this reason, the agreement needs to specify which state law governs the agreement.

Indemnification Clause

The crux of any indemnification agreement is the indemnification clause itself. This section spells out what acts are indemnified against. The wording should be clear and detailed so that it’s not left open to later interpretation. It typically includes language that states that the indemnitor agrees to “indemnify, defend, and hold harmless” the indemnitee.

Scope of Coverage

It’s important for the indemnification agreement to clearly define the scope of the coverage. It should detail the extent of the protection for the indemnitee. If you’re the indemnitor, you should ideally limit the scope to those liabilities arising from your firm’s actions.

Exceptions

This section should spell out all conditions under which the indemnitee is not protected. These conditions will vary, depending on the contract, but often include issues where the indemnitee:

- Acted in bad faith

- Acted unreasonably

- Committed a criminal offense

- Benefited from the action

- Receives compensation under another indemnification agreement or insurance policy

The goal here is for the indemnitor not to be responsible if the indemnitee was grossly irresponsible, commits an action in which it can profit, or otherwise receive compensation from another party.

Notice and Defense of a Claim

All indemnification agreements should detail how the indemnitee should notify the indemnitor of a dispute or claim. It should also spell out how the indemnitor can defend against a claim.

Settlement and Consent Clause

This clause details how both parties get the other’s consent for settling a claim covered under the agreement.

Enforcement

How is the indemnification agreement enforced? That’s what’s covered in this clause—what can the indemnitee do if the indemnitor refuses to fulfill obligations?

Duration

Finally, the indemnification agreement should detail the specific length of time for which the protections in the agreement continue.

Let Contract Logix Automatically Add Indemnification Agreements to Your Contracts

Adding an indemnification agreement or clause to a contract is easy when you’re using the CLM Platform from Contract Logix. Our cloud-based contract management software automates the entire contract workflow, from creation to execution and archiving. Simply create contract templates that include preapproved indemnification language, and you’ll lower your risk for every contract you engage in. We’ll also help you better manage all your contracts, create a more efficient contract workflow, and reduce contract-associated costs—because we know how to make a better contract management process.

Contact Contract Logix today to learn more about indemnification agreements and contract management.

Read another recent article from our team, How to Get Contract Approval Quickly and Efficiently.