Why PE & VC Firms Should Require Portfolio Companies to Use CLM Software

June 10th, 2024

Venture capital (VC) and private equity (PE) firms play pivotal roles in driving business growth and innovation. VC firms typically invest in early-stage companies, providing essential capital to help them develop and scale. These investments can range from small startups to large, rapidly expanding businesses.

On the other hand, private equity firms focus on more mature businesses. They invest substantial capital, often acquiring or merging businesses to optimize operations and drive growth. These firms inject significant resources into their portfolio companies, making efficient contract management crucial to their success. Effective contract management ensures all parties, including buyers, sellers, vendors, and suppliers, adhere to agreed terms, thus protecting investments and supporting strategic objectives.

In this dynamic landscape, contract lifecycle management (CLM) software becomes indispensable. By requiring their portfolio companies to adopt CLM software, PE and VC firms can ensure processes are streamlined, risk is mitigated, and overall performance is optimized.

Quick Takeaways

- Automating contract management processes saves time and reduces administrative burdens, enabling portfolio companies to focus on strategic initiatives.

- Ensuring compliance with regulatory requirements through automated alerts and a clear audit trail reduces the risk of legal disputes and supports adherence to standards like SOX.

- Centralized access to contract data enhances transparency and control, allowing firms to track performance, monitor milestones, and optimize contract terms proactively.

- Standardizing contract processes promotes consistency and best practices, improving the quality of agreements and supporting scalability as companies grow.

😉 Bonus: Discover CLM best practices in our Dos and Don’ts of Contract Lifecycle Management.

1. Efficiency and Time Savings

Contract lifecycle management software significantly enhances efficiency and saves time by automating and streamlining the entire contract management process. Portfolio companies can efficiently create, negotiate, approve, and manage contracts, reducing administrative burdens and freeing up resources to focus on strategic initiatives.

According to Gartner, 50% of organizations will support supplier contract negotiations through the use of automated contract risk analysis and editing tools by 2027. This efficiency is crucial for portfolio companies aiming to scale and adapt quickly in competitive markets.

2. Risk Mitigation and Compliance

CLM software plays a key role in mitigating risk and ensuring compliance with regulatory requirements. It provides automated alerts for key dates and obligations, helping portfolio companies stay on top of contract terms and avoid legal disputes.

For instance, maintaining compliance with the Sarbanes-Oxley Act (SOX) is critical for companies preparing for public offerings or acquisitions. CLM software ensures a rigorous process and automatic audit trails, demonstrating proof of compliance and tracking financial approvals accurately. This capability is essential for private equity firms requiring their portfolio companies to adhere to stringent regulatory standards.

3. Visibility and Control

For private equity and venture capital firms, having visibility into the contracts of their portfolio companies is crucial for assessing risk and making informed decisions.

CLM software provides centralized access to contract data, allowing stakeholders to quickly and easily track performance, monitor contract milestones, and identify opportunities for optimization. This centralized approach not only enhances transparency, but also enables better control over the contractual processes, reducing the likelihood of missed obligations or critical deadlines.

Enhanced visibility and control facilitates proactive management, allowing firms to address potential issues before they escalate and optimize contract terms for better outcomes.

4. Standardization and Consistency

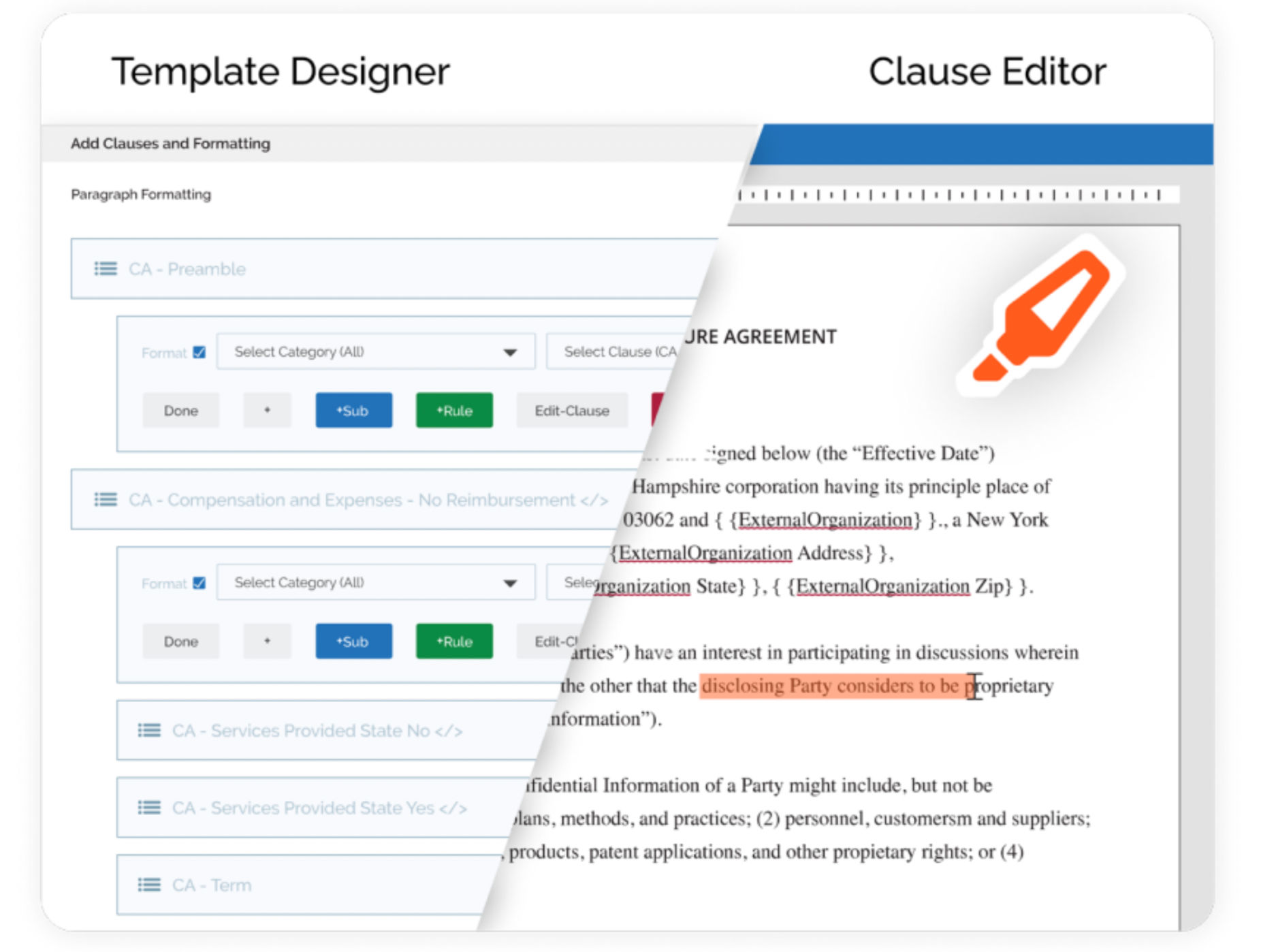

Standardizing contract processes across portfolio companies is essential for promoting consistency and best practices. CLM software facilitates this by allowing organizations to:

- Establish templates

- Enforce contract standards

- Streamline and automate workflows

This ensures all contracts align with company policies and objectives, reducing variability and potential errors.

Standardized contracts not only save time, but also enhance the quality of agreements by incorporating pre-approved clauses and terms that have been legally vetted. This uniformity supports scalability, as portfolio companies grow and engage in more complex transactions. By providing a structured approach to contract management, CLM software fosters a culture of reliability and professionalism across the organization.

5. Scalability and Growth

As portfolio companies scale and expand their operations, manual contract management becomes increasingly unsustainable. CLM software offers scalability, efficiently managing larger volumes of contracts without adding administrative overhead. This adaptability is crucial for companies experiencing rapid growth or entering new markets.

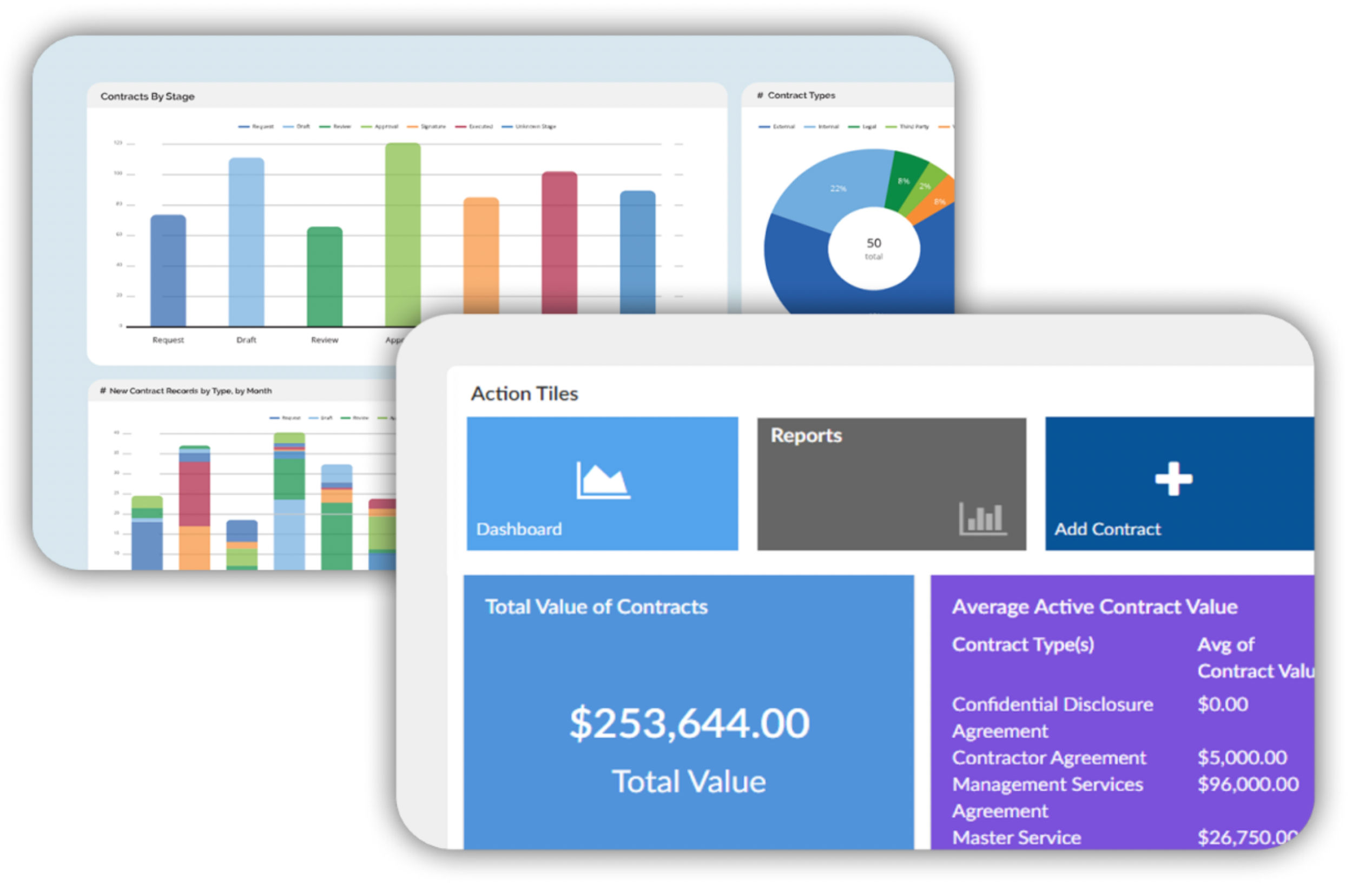

The software can accommodate evolving business needs by integrating with other enterprise systems, ensuring contract management processes remain seamless and effective. Moreover, CLM software supports strategic growth initiatives by providing robust analytics and reporting capabilities.

These insights help companies identify trends, optimize contract terms, and negotiate better deals, ultimately driving business success.

6. Enhanced Due Diligence and Exit Preparedness

During due diligence processes and exit events, comprehensive contract data is crucial for valuation and risk assessment. CLM software centralizes contract documentation, making it easily accessible for review and analysis. This centralization accelerates the due diligence process, enabling faster decision-making and reducing the risk of overlooking critical contractual obligations or liabilities.

For private equity firms, having detailed and organized contract records is vital when preparing for exits, whether through public offerings or acquisitions. The ability to quickly provide potential buyers or investors clear, complete contract histories can significantly enhance the attractiveness and valuation of portfolio companies.

7. Competitive Advantage

Adopting CLM software provides portfolio companies with a competitive edge by:

- Improving negotiation outcomes

- Reducing contract cycle times

- Enhancing customer relationships

Streamlined contract management processes enable quicker response times and more efficient deal closures, which are critical in fast-paced environments.

Successful CLM applications affect the top line as well as the sales organization’s effectiveness by reducing contract cycle times by 50% or more and automating contract renewals, which often increases their total value.

Additionally, improved contract management demonstrates a commitment to operational excellence, which can differentiate portfolio companies from competitors. This competitive advantage not only attracts potential investors, but also strengthens relationships with customers, suppliers, and other stakeholders.

8. Alignment with ESG Initiatives

Environmental, Social, and Governance (ESG) considerations are increasingly important for investors. CLM software supports ESG goals by promoting transparency, accountability, and responsible business practices across the contract lifecycle.

By centralizing contract management, CLM software ensures all agreements adhere to the company’s ESG policies and regulatory requirements. This centralization also facilitates better reporting and auditing, allowing companies to demonstrate their commitment to sustainable and ethical practices.

According to Deloitte’s 2023 CxO Sustainability Report, 61% of executives believe climate change will significantly impact their organization’s strategy and operations over the next 3 years, and many have increased their sustainability investments accordingly.

CLM software aids in this integration by providing tools to monitor and enforce ESG standards, making it easier for portfolio companies to align with investor expectations and regulatory mandates.

Maximize Portfolio Value with Contract Logix

Requiring portfolio companies to utilize CLM software offers numerous benefits for PE and VC firms, including enhanced efficiency, risk mitigation, and improved visibility. This technology automates and standardizes contract processes, scales with company growth, and supports strategic initiatives like ESG compliance.

By leveraging Contract Logix’s CLM software, private equity and venture capital firms can drive better performance through efficient contract creation, negotiation, and management. Our software ensures regulatory adherence by automating compliance checks and providing a clear audit trail, essential for maintaining standards like Sarbanes-Oxley (SOX). Additionally, the centralized access to contract data offers enhanced visibility and control, giving firms a competitive advantage.

Explore how Contract Logix can help your investment firm and portfolio companies optimize contract processes and ensure regulatory adherence. Discuss your specific needs with our team or request a personalized demo to see how our platform can enhance your performance.

Navigate CLM Success With Contract Logix

Download our Data Extraction Product Brief to learn how you can begin to navigate CLM success by automating the hard work using artificial intelligence with one of the best Contract Management Software’s on the market today