How to Detect Fraud in Accounting with Contract Management Software

Do you know how to detect fraud in accounting? There are several established techniques you can employ, all of which are made easier by the use of contract management software.

That’s right, the same software you use to automate the contract lifecycle can help detect and reduce accounting fraud in your business. It’s all about establishing standards and controls, which contract management software does quite well.

Key Takeaways

- Accounting fraud has a significant impact on all types of businesses and nonprofits.

- To prevent fraud, perform employee background checks, implement internal controls, employ external audits, establish company fraud policies, be willing to punish fraudsters, and quickly report all fraudulent activities.

- Contract management system software is an important tool for detecting and preventing accounting fraud.

- Contract management software platforms help to standardize contract language, prevent nonstandard contracts and behavior, eliminate altered or fraudulent documents, flag deliverable discrepancies, and make auditing easier.

How Common is Accounting Fraud?

Accounting fraud is a blight upon businesses of all types. The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of their revenue every year to fraud. The typical fraud case goes on for 14 months before it’s detected, causing an average loss of $8,300 per month. That adds up to a median loss per case of $125,000.

Even more disturbing, the incidence of account fraud appears to be increasing during the COVID-19 pandemic. The ACFE found that 51% of organizations surveyed uncovered more fraud since the onset of the COVID crisis – and 71% expect the level of fraud to continue to increase over the coming year.

How Can You Prevent Fraud in Your Business?

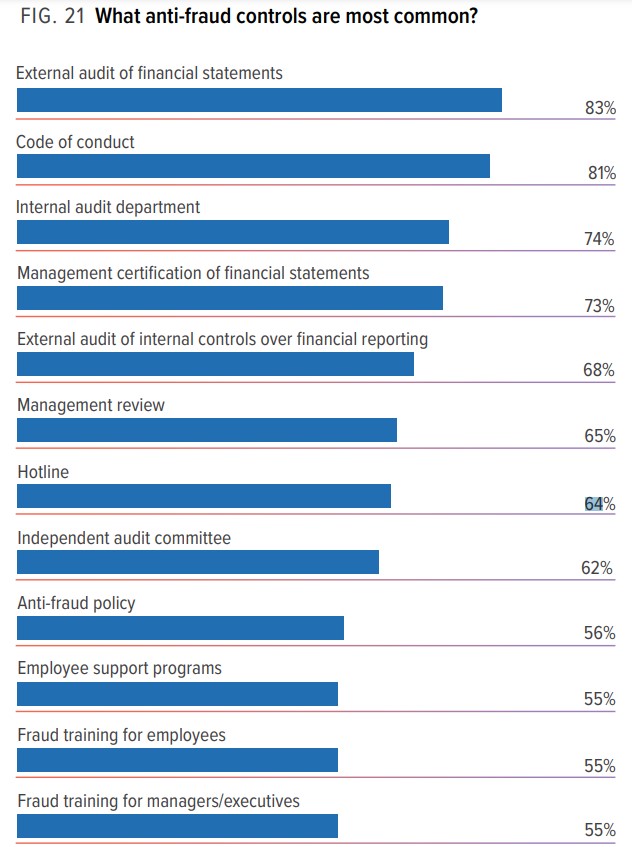

There are many ways an organization can work to reduce or prevent accounting fraud, from external audits to fraud training.

SOURCE: https://www.acfe.com/report-to-the-nations/2020/

The ACFE recommends six proven fraud prevention techniques that you can employ in your business. They are:

- Employing internal controls

- Instituting universal background checks for all new employees

- Performing regular fraud substantive audits

- Establishing detailed fraud policies

- Being willing to punish employees found engaging in fraudulent activities

Conducting regular fraud detection and investigation

We’ll look at each method in more detail.

Perform Employee Background Checks

Anti-fraud protection starts before you hire new employees. You need to perform background checks on all potential hires and weed out those candidates who have had obvious issues with former employers. Background checks won’t catch every potentially bad actor, but they will thin out the pool.

(The following video discusses why employees commit fraud.)

SOURCE: Global Maestro via YouTube

Implement Internal Controls

Another effective way to reduce the risk of accounting fraud is to implement strict internal controls. These typically take the form of regular internal audits that help identify any potential issues before they become major problems. These controls also serve to deter both internal and external actors from attempting fraudulent activity.

Employ External Audits

Many savvy fraudsters know how to avoid internal controls and procedures to hide their fraudulent activities. An external audit will catch things that might slide by internal audits, whether they’re caused by fraud or human errors.

Establish Detailed Fraud Policies

Your organization needs a set of detailed policies regarding accounting fraud, and those policies need to be well known among all relevant employees. Your accounting and contracting staff need to know what’s acceptable and what constitutes fraud.

Be Willing to Punish Fraudsters

Not only must your company have established policies regarding accounting fraud, but you must also be willing to punish those found engaging in such activities. Your staff needs to know what happens if they get caught cheating – and it should be major.

Detect, Investigate, and Report

The final way to prevent accounting fraud is to develop a policy of detecting, investigating, and then reporting any suspected instances of fraud. You need to report all fraudulent activity to the appropriate legal authorities and industry governing bodies as soon as possible. Not only does acting quickly minimize the cost of ongoing fraud, but it also helps you comply with all applicable regulations – and brings the culprit to justice that much faster.

How to Detect Fraud in Accounting with Contract Management Software.

How can your organization best effectuate these fraud-prevention guidelines? While some of these actions, such as employee background checks, fall outside the contract management process, others are easily integrated into a contract management software solution, such as Contract Logix’s data-driven CLM platform. Here are just a few of the ways that a contract management software solution can detect and help prevent accounting fraud.

Standardizes Contract Language

Some fraudsters try to execute fraud by putting their own language and clauses into the contracts they create. Contract management software platforms eliminate the risk of rogue contracts by using preapproved contract clause and template libraries to standardize language and contract types. This ensures that no fraudulent language gets into your contracts.

Standardizes the Contract Process

Contract management software automates the entire contract process, from origination to execution and beyond. Contracts automatically flow from one individual or department to the next based on your business rules, which speeds up the workflow and eliminates any opportunity for fraudsters to circumvent the process. Every contract flows through a standardized process designed to reduce all forms of contract risk, including fraud.

Eliminates Altered or Fraudulent Documents

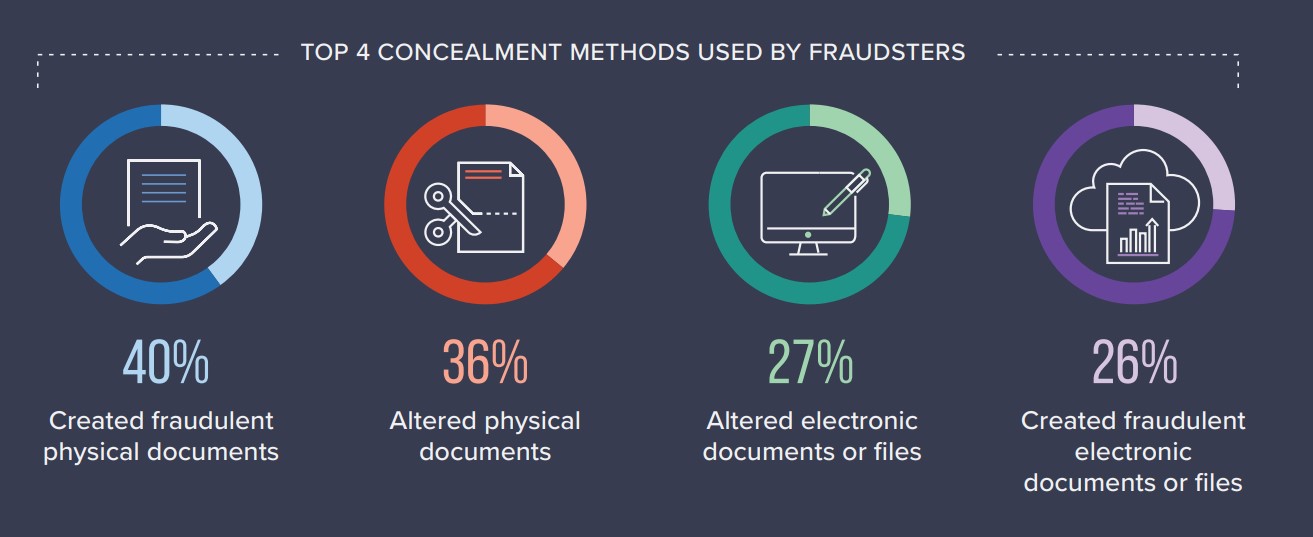

The most common way that fraudsters seek to conceal their activities is by creating fraudulent documents or altering existing documents or files.

SOURCE: https://www.acfe.com/report-to-the-nations/2020/

Because all contract requests and submissions, as well as the actual contracts, have to go through the contract management software, there is zero opportunity for fraudsters to alter or create fraudulent contracts.

Centralizes All Contracts

Fraudsters often mask their activities by operating outside of the mainstream. With contract management, this typically manifests in contracts created in far-flung departments or locations outside of the watchful eyes of the home office. Contract management software platforms centralize all contract activity so that contracts are no longer created across the organization, thus minimizing the opportunity for fraudulent activity.

Flags Discrepancies in Deliverables

Some employees commit fraud after a contract has been executed by manipulating payments or deliverables. With contract management software, all post-execution activity is automated and closely monitored, reducing the opportunity for fraudsters to game the system. This also helps minimize the risk of missed obligations through the use of automated alert rules.

Provides for Easier Audits

Finally, centralizing all contracts and supporting documents in a single digital repository makes it easier to conduct both internal and external audits. Every single document is available at the click of a mouse, so auditors don’t have to spend hours or days searching for what they need. Contract management software from Contract Logix also automatically maintains all version control and keeps a complete historical record of all activity associated with a contract since the moment is was request. This results in an extremely accurate and easy-to-product audit trail.

Let Contract Logix Help You Minimize the Risk of Accounting Fraud

When you want to minimize the risk of accounting fraud in your organization, turn to the contract management experts at Contract Logix. Our CLM software automates the entire contract process and implements the measures your company needs to detect fraud in your accounting and contracting processes.