How to Provide Secure Contract Management for FinTech Services

Dec 14th, 2022

How secure is contract management in your FinTech business? The FinTech industry is an appealing target for hackers and fraudsters, so it’s important that your contracts be as secure as possible. Providing secure contract management is challenging but worth the effort — the consequences could be catastrophic if your firm becomes the victim of a contract-related data breach.

Key Takeaways

- Contract management presents a particular risk for FinTech companies

- Contracts can be targets of data breaches, contract fraud, and other malicious activities

- To improve contract management security, centralize contract storage, limit and regulate access to contract data, employ strong password protection, and encrypt all contract data

- A better way to ensure contract security in FinTech firms is to employ contract lifecycle management software, such as that offered by Contract Logix

Risks of Contract Management for FinTech Services

The FinTech industry relies on data and technology for its day-to-day operations. That reliance is also a risk if systems are hacked or data is breached.

Contract management represents a particular risk for FinTech firms. Not only are contracts often difficult to track and manage, they also represent an attractive target for fraudsters, hackers, and other malicious actors.

What are some of the biggest contract management risks for FinTech companies? The most significant include:

- Data breach from malicious actors

- Breach of partner or third-party provider systems

- Internal fraud

- Violations of customer privacy

- Noncompliance with government and industry regulations

- Late or missing deliverables

- Legal breach of contract

- Lost data

Providing more secure contract management can mitigate many of these risks. Weak contract management will increase these risks — especially the risk of third-party data breach.

Making Contract Management for FinTech More Secure

FinTech firms are a particular target for cybercriminals, as are contracts. According to IBM’s Cost of a Data Breach Report 2021, data breach costs in the financial industry are second only to those in healthcare, at $5.72 million per breach on average.

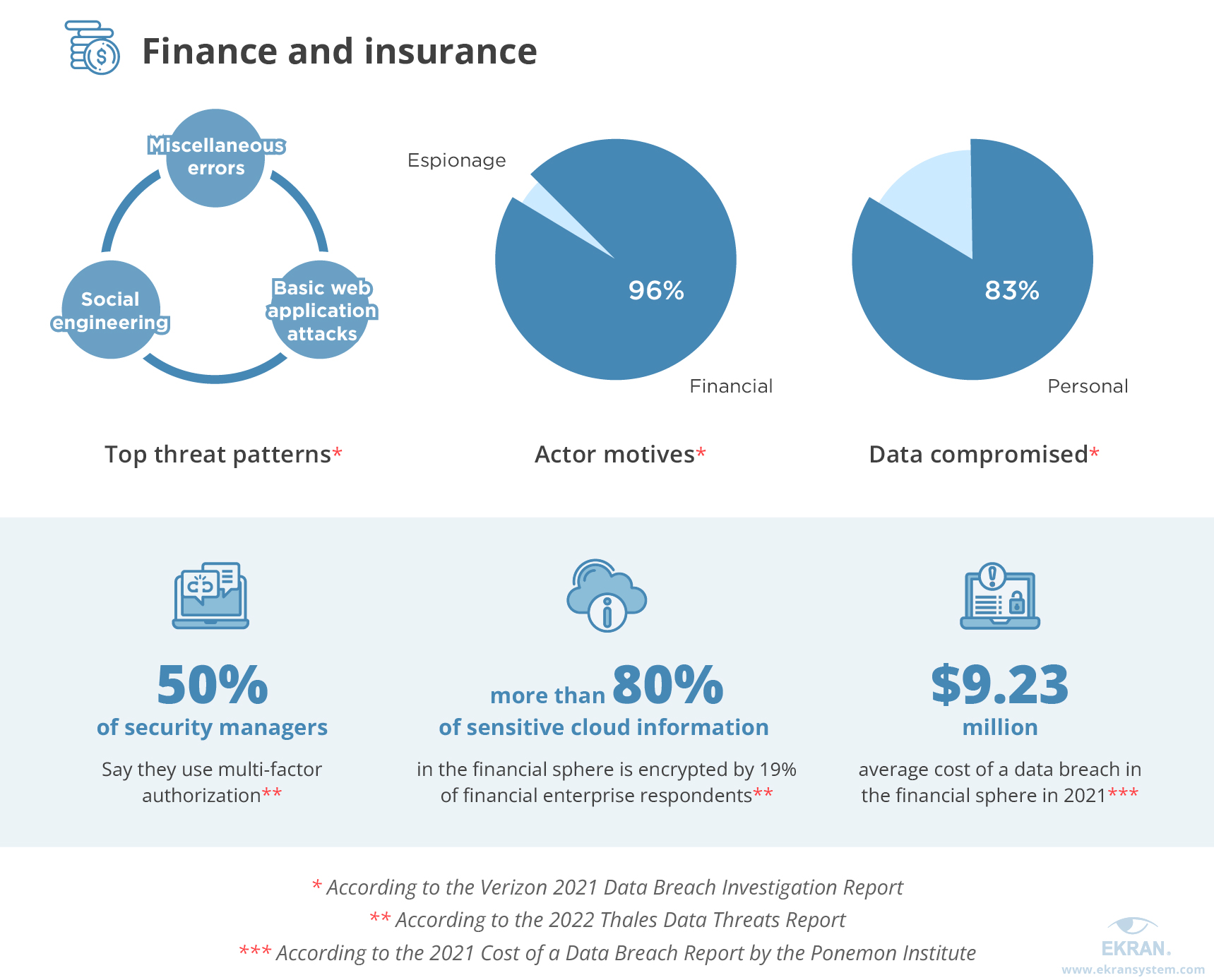

SOURCE: https://www.ekransystem.com/

Secure contract management is a necessity in FinTech, and that requires a combination of savvy contract management and robust cybersecurity. Here are eight essential things any FinTech firm can do to beef up contract management security.

Keep All Software and Hardware Updated

Hackers like to exploit known security holes in operating systems, software, and hardware. To keep this from happening, your IT department needs to regularly update all software and hardware when security patches and upgrades are issued. You need to update your systems before hackers can exploit known issues.

Centralize Contract Storage

The more places you store your contracts, the more targets you give malicious actors. Storing contracts in multiple departments and multiple physical locations makes it harder to secure those contracts and provides hackers more opportunities to breach your security. A single centralized and digital contract repository is easier and less expensive to secure than trying to guard a dozen or more similar databases. There are other benefits centralizing all your contracts (it makes it easier to find contracts when you need them, for example), but the security benefit alone makes it essential that you break down your data silos and centralize your contract storage.

Limit Access

According to the Varonis 2021 Data Risk Report, 64% of financial service companies have more than a thousand files accessible by every employee in the firm. That is a significant security risk. The more employees that have access to data, the greater the risk that data can be breached. Every employee with access is a potential gateway for hackers.

To improve contract security, you need to limit access to your stored contracts. Not every employee needs to access every contact. Employ zero trust access to restrict access only to those with legitimate needs. The fewer points of access into your contract database, the more secure it remains. You’ll want to employ role-based and feature-based permissions to ensure appropriate access to sensitive information. It’s also important to use software that is SOC 2 Type II certified.

Employ Strong Password Protection

It should go without saying that all contract data should be password protected, otherwise anyone can walk in off the street and access your contract data. You should insist that all employees create strong, hard-to-guess passwords to keep hackers from easily breaking less-secure passwords. Use long passwords with plenty of numbers and special characters, and require employees to change those passwords on a regular basis. (Employing multifactor authentication is also a good idea, as it provides an extra layer of security beyond that of password protection.)

SOURCE: https://www.nomios.com

Encrypt All Contract Data

If your contract data is breached you want to ensure that hackers can’t use the data they steal. The best way to do that is to employ data encryption, which essentially scrambles all data unless one has the official decryption key. Any unauthorized user trying to read an encrypted contract sees an unintelligible mush. When storing your contracts in a cloud-based repository like Contract Logix, you’ll want to ensure all data is encrypted both at rest and in transit.

SOURCE: TheUnlockr via YouTube

Deal Only with Partners with Strong Security Standards

Picking the wrong partners can jeopardize your contract security. According to Verizon’s 2022 Data Breach Investigations Report, 62% of reported incidents involved compromised partners. It doesn’t matter how strong your security is, if your partners can be easily hacked, malicious actors can use a partner breach as a gateway into your system.

You should require any partner with any access to your system to meet or exceed your company’s cybersecurity standards. When you evaluate your cyber defenses, you need to evaluate your partners’ cybersecurity as well.

Conduct Internal and External Audits

Not all security breaches involve technology. Old fashioned accounting fraud can hit any FinTech firm — much of it instigated by internal players.

To protect against contract fraud, implement strict internal controls and conduct regular internal audits. A robust audit will identify and help you stop fraudulent activity. For even stricter control, supplement internal audits with external ones, which often catch activities that savvy fraudsters might be able to hide from internal auditors.

Embrace Contract Lifecycle Management

Finally, the best way to ensure secure contract management for FinTech or any industry is to employ contract lifecycle management (CLM) software, such as that offered by Contract Logix. By digitizing and automating the entire contract process, a robust CLM solution provides a level of security impossible with manual systems.

Here are just a few of the many ways that a CLM solution improves contract security:

- Standardized contract language prevents fraudsters from surreptitiously inserting their own favorable language and clauses into contract they create.

- Standardized contract process deters fraudsters from circumventing the process for their own ends.

- Centralized contract database minimizes potential access points for hackers.

- Automated deliverables monitoring blocks malicious actors from manipulating payments or deliverables.

Choose Contract Logix for Secure Contract Management for Fintech

Banks, brokerages, and other FinTech firms are attractive targets for all types of malicious actors. To improve security and reduce the risk of contract fraud and data breach, turn to a robust contract management solution.

Contract Logix’s CLM solution for financial services is designed to transform contract management for the FinTech industry. You get complete visibility into your end-to-end contract process so you can easily identify and mitigate contract risk and improve contract security. Our CLM solution automates the entire contract process, from creation to execution and beyond, ensuring that you remain compliant with all regulatory requirements and stay on top of all deliverables. It’s the smart and secure way to manage your FinTech contracts.

Contact Contract Logix to learn more about secure contract management for FinTech companies.

Looking for more articles about Contract Management? Check out our previous article “Smart Contract security in 2023: A Simple Checklist“.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence