How to Master M&A Contracts: A Comprehensive Guide

Sept 13th, 2023

A merger and acquisition (M&A) contract might be the largest agreement your company ever executes, both in size and stakes.

M&A contracts are high-stakes legal documents that can lead to the sale, partnership, or dissolution of an entire organization. Since the stakes are high, organizations take extra measures to mitigate risks—from using specialized software for contract lifecycle management to hiring legal and banking professionals in M&A contracts.

Acing an M&A contract involves preparing a sound contract with the right components, negotiating confidently and effectively, and using robust contract management software. This guide will explain all three steps and reveal the best contract management software for mergers or acquisitions.

Key Takeaways:

- Mergers and acquisitions are related but separate methods of transforming two distinct organizations into a single business entity.

- M&A contracts are complex and high-risk, so organizations take extra care to execute them correctly.

- Contract Logix offers a robust contract management software to help organizations mitigate M&A contract risks.

😉 Bonus: Learn more about how contract management software works here.

Key Components of M&A Contracts

To ace mergers and acquisition contracts, you need to first understand their key components.

What are Mergers and Acquisitions?

Mergers and acquisitions, while related, serve distinct purposes.

In a merger, two companies join forces to carry forward as a single business entity. In contrast, an acquisition sees one company taking ownership of another. Although both lead to the fusion of two entities, their structure differs significantly.

This difference in structure underscores the need for M&A contracts. Mergers and acquisitions involve many moving pieces, so a well-managed contract is essential.

Even for major companies like Amazon that regularly acquire other organizations, an M&A remains a significant undertaking. Coming prepared with the right research and software can make all the difference.

What’s in an M&A Contract?

A business contract contains comprehensive information about the terms and conditions of a business transaction. In an M&A contract, the transaction in question is a major one: a merger or acquisition. To excel in crafting an M&A contract, ensure it contains these key components:

- Price and terms: Clearly state the purchase price and payment terms, whether it’s a lump sum or structured installments. Since contracts are legally binding, include details like timeframes and currencies as well.

- Assets and liabilities: Two entities becoming one is a complicated endeavor. Your M&A contract should specify which assets and liabilities each company will transfer or assume. The contract must also specify what type of merger or acquisition will be taking place.

- Termination fees: Mergers and acquisitions can be costly and time-consuming, so organizations involved naturally want to avoid expending resources on a contract that will fall through. To act as a safety net, your M&A contract might include termination fees that establish a penalty if one party breaks off the agreement.

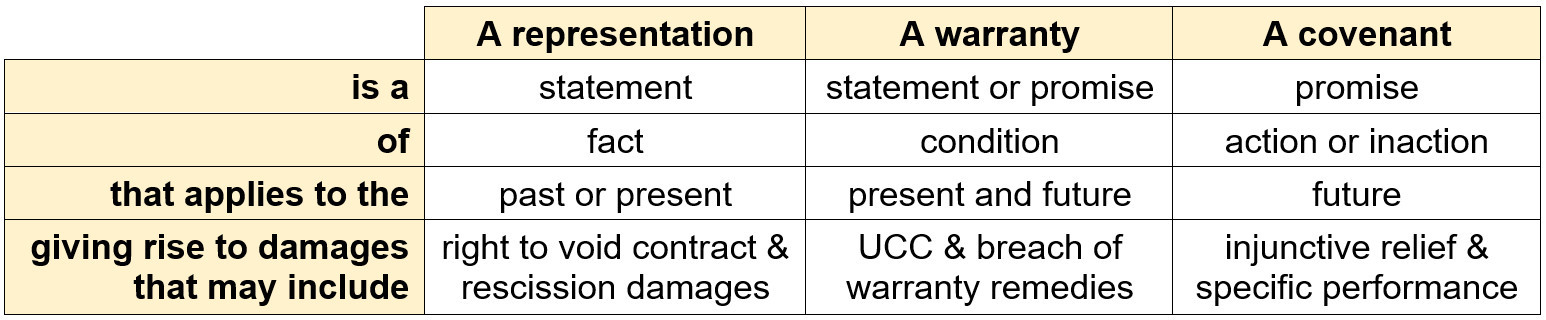

- Representations and warranties (R&W): These are statements a business makes about facets like its financials, ongoing lawsuits, or regulatory compliance. During due diligence, businesses verify these R&Ws for accuracy.

While these are some of the most important tentpoles of your M&A contracts, it’s by no means a comprehensive list. Collaborate with a legal professional that specializes in M&As to ensure your contract is sound and complete.

Image Source: https://www.linkedin.com/pulse/representations-warranties-covenants-why-theyre-matters-eric-lambert/

Negotiating Mergers and Acquisition Contracts

Once you’ve drafted your M&A contract with all key components, it’s time to enter into the negotiation phase. While M&A negotiations can be volatile and difficult, following these steps can ensure a successful outcome:

- Define your goals. What does success look like for your organization? Clearly define your goals, including any non-negotiables and potential deal-breakers the other party should be aware of.

- Do your due diligence: Think about the research you did before purchasing your home or car. Chances are, you conduct research before deciding where to buy gas or eat dinner, so you should take even more care researching a transaction as major as a merger or acquisition. Comprehensive due diligence uncovers hidden risks, identifies mistakes, and positions you to negotiate from an informed standpoint.

- Build rapport and trust: Harvard Law School’s Program on Negotiation warns that agreeableness can be both a blessing and a curse. Trying too hard to protect a business relationship can cause negotiators to claim less value for themselves, compromising their interests. However, likable negotiators often secure better deals, because people naturally favor those they like—this holds true in our friendships and relationships, but also in the boardroom.

- Anticipate challenges: While both parties generally benefit from an amicable negotiation, the purpose of negotiation is to maximize value. As such, enter negotiations expecting pushbacks and be prepared to assert your points.

Image Source: https://www.investopedia.com/terms/d/duediligence.asp

Mitigating Contract Risk

Enterprise contracts inherently involve risk, and M&A agreements are no exception. Given the added stakes of dissolving or incorporating an entire organization, you need to mitigate your risks for these types of contracts.

Financial Risk

During due diligence, conduct a thorough research about the other organization’s finances and prospects. No amount of due diligence can completely ameliorate the risk of poor future performance, but the right mix of preparation and technology can help you mitigate other M&A contract risks.

These include overlooking payment terms, making uninformed financial commitments, or payment defaults. Contract management software such as Contract Logix can help organizations manage these risks by tracking financial information, logging dates, and automating workflows.

Legal Risk

Even the most polished contracts can be open to interpretation. Legal disputes can arise from things like:

- Poorly defined terms in the contract

- Inaccurate representations or warranties

- Regulatory non-compliance

- Breach of contractual obligations

- Unclear Language

The cheapest and easiest way to resolve a legal dispute is to prevent it. That’s why companies involved in mergers and acquisitions use contract lifecycle management software to monitor contract language and terms, as well as compliance with regulations and ongoing obligations. This helps companies avoid costly legal disputes.

Reputational Risk

M&As can jeopardize your reputation. Oversights like missing a milestone, failing to adhere to the terms of your contract, or using unclear language that results in a major dispute can impact your reputation (in addition to your bottom line).

To safeguard your reputation, use software that helps you stay on top of your obligations by tracking important dates, monitoring contract terms, and even managing contract language.

M&A Contract Management Software

Whether you’re being acquired, merging, or doing the acquiring yourself, M&As are high-stakes endeavors.

Contract Logix supports organizations in mitigating contract risks throughout the contract lifecycle. From drafting and negotiation to execution and storage, Contract Logix ensures you meet your obligations and safeguard your interests in M&A contracts.

Experience the transformative impact of Contract Logix in your organization. Request a demo today.

Looking for more articles about Contract Management? Check out our previous article “A 10-Point Checklist for Contract Renewals“.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence