The Contract Compliance Audit Process – Introductory Guide

How compliant are your company’s contracts? You can improve compliance with a robust contract compliance audit. The contract compliance audit process helps identify and resolve various contract-related issues. It can also reduce your contract risk and improve your overall contract management process.

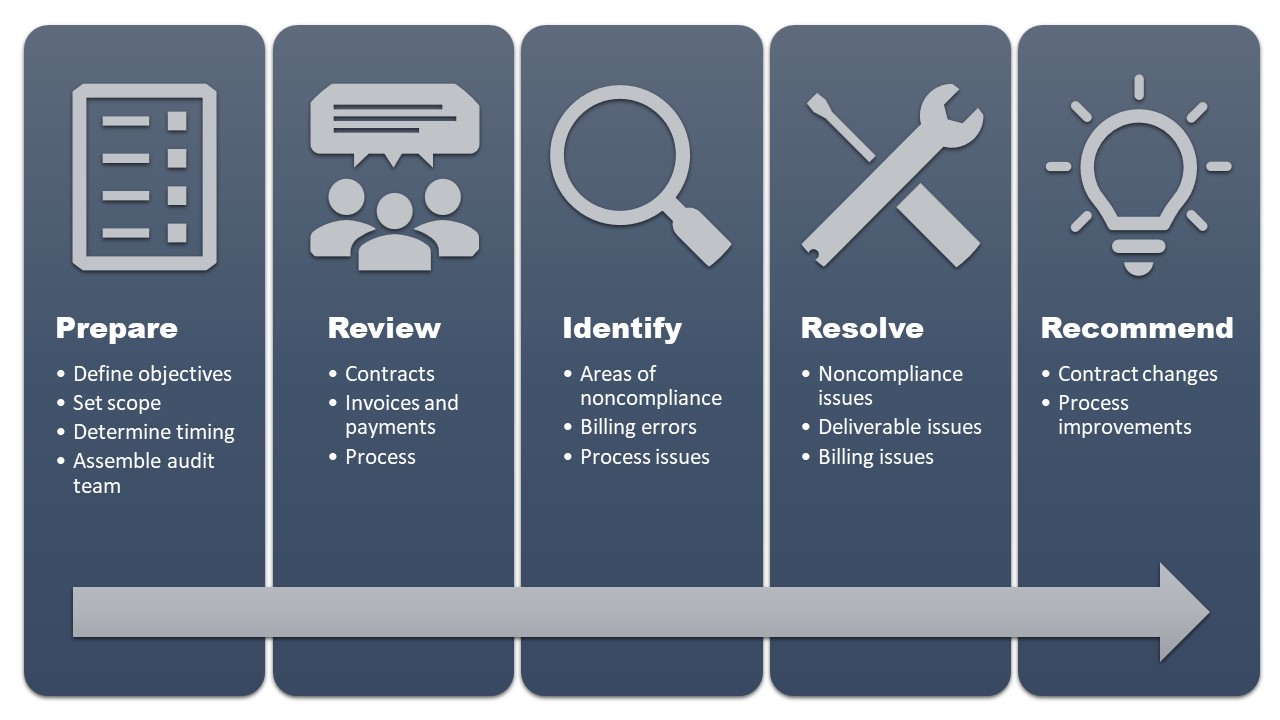

Do you know what it takes to conduct a contract compliance audit? As you’ll see, it’s a five-step process that involves preparation, reviewing existing contracts, identifying issues, resolving those issues, and then recommending any necessary changes. Given the resulting benefits, it may be time for your organization to schedule a contract compliance audit – and use this introductory guide to get started.

Key Takeaways

- A contract compliance audit is a review of your contracts and contract management processes

- Contract compliance audits can be either reactive to certain events or proactive on a regular basis

- The contract compliance audit process consists of five major steps: preparation, review, identification of issues, resolution of issues, and recommendations

- A contract compliance audit provides many benefits to an organization, including improving contract compliance, better understanding obligations and options, improving financial billing and receiving accuracy, and enhancing your contract management process

What is a Contract Compliance Audit?

A contract compliance audit reviews your contracts and processes to ensure that they’re compliant with internal and external standards, regulations, and business rules. A contract compliance audit also examines each contract to ensure that both parties’ terms are being honored.

When Should You Undertake a Contract Compliance Audit?

A contract compliance audit can be reactive or proactive. There are good reasons for both types of audits.

Reactive Audits

A reactive audit occurs in reaction to some internal or external event or concern. You can initiate reactive audits or have them forced upon you by a third party, such as a regulatory body like HIPAA or Sarbanes-Oxley (SOX).

Some of the most common reasons for a reactive audit include:

- Terminating a relationship with a vendor or client

- Beginning relationship with new vendor or client

- Suspected risk for a major vendor or client

- Pending renewal of evergreen contracts

- Organizational changes

- Personnel changes, especially in procurement or contracting departments

- Expansion into new markets

- Upcoming merger or acquisition

- Upcoming large capital expenditure requiring new loan or funding

Proactive Audits

A proactive audit is one that you initiate willingly with no triggering event. Many organizations conduct regular contract compliance audits, typically annually, to provide checks and balances for their contract management process. Initiating a proactive contract audit is a good way to identify potential issues before they become major problems and ensure ongoing compliance with internal and external regulations.

What is the Contract Compliance Audit Process?

A contract compliance audit will be different for different organizations. That said, there are some general steps all audits should follow, as detailed here.

1. Prepare

The first step in the contract compliance audit process is preparing for the audit. This typically consists of several related activities:

- Define objectives – determine what you want to find out from the process

- Set the scope – determine if the audit is for specific contracts such as MSAs, BAAs, CDAs, etc. (or contracts with a specific partner, vendor or client) or for your entire contract portfolio

- Determine timing – determine the best time to start and estimate how long it will take

- Assemble audit team – pull together the individuals who will perform the audit (can be internal staff, external auditors, or a mix)

2. Review

Once the objectives and scope have been set, your audit team can get to work. The team should review the following:

- Existing contracts – both on your paper and third-party paper (buy-side and sell-side)

- Invoices and payments related to your contracts

- Contract management process

3. Identify

During the review process, the team should seek to identify the following types of issues:

- Areas of noncompliance and nonperformance

- Billing errors related to your contracts

- Process issues

- Other contractual obligations, dates, and milestones

If possible, the team should attempt to quantify the costs related to each identified issue.

4. Resolve

Finding a problem isn’t the end of a process. Any issues identified should be flagged for resolution and potential risks should be scored by the consequence and probability, including:

- Noncompliance issues

- Performance (deliverable) issues

- Billing issues

5. Recommend

Finally, the audit team should step back from individual issues and make recommendations on how to ensure the issues they found won’t be repeated. This includes recommending:

- Contract changes

- Process improvements

The goal is to ensure more compliant contracts and a smoother contract management process.

What Are the Benefits of a Contract Compliance Audit?

Contract compliance is essential. So much so that 57% of senior executives say compliance and risk management are the top priority for their firms. A contract compliance audit can help improve contract compliance, among other significant benefits.

Improve Contract Compliance

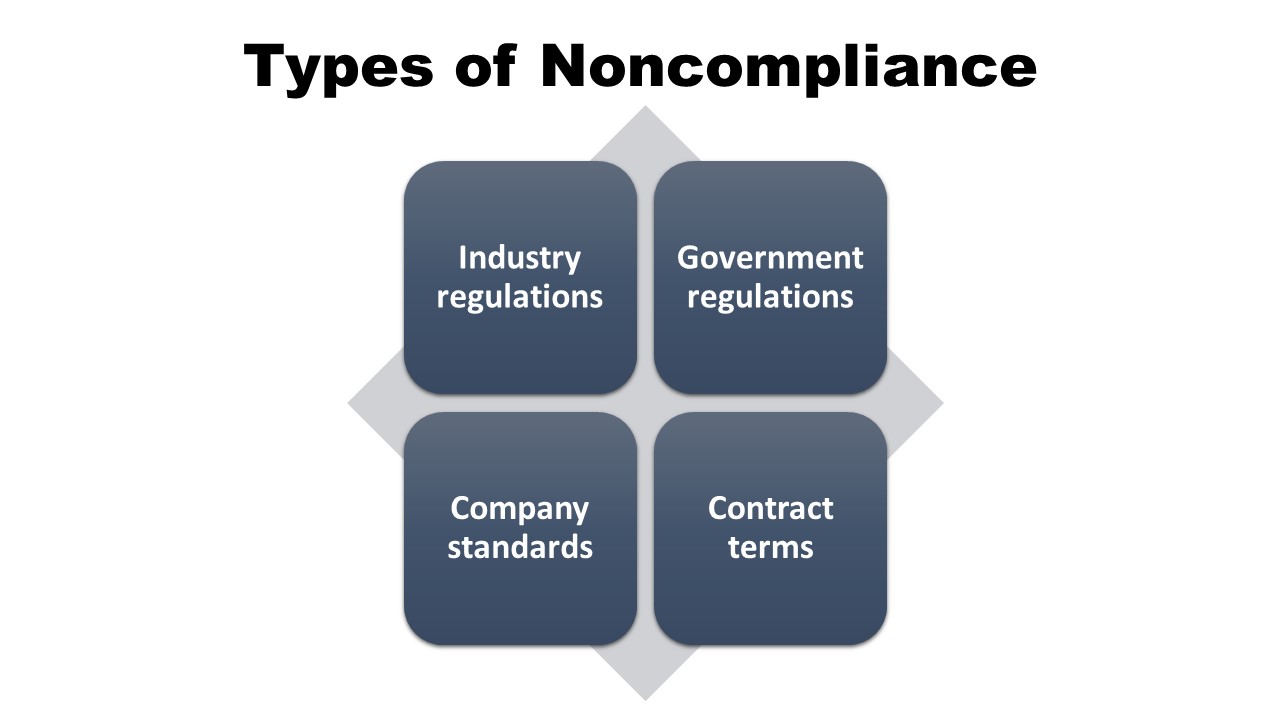

Contract non-compliance, in all of its many forms, can be costly. There are several ways for a contract to be non-compliant:

- Noncompliant with state and federal government regulations, such as the California Consumer Privacy Act (CCPA) and the Sarbanes-Oxley Act

- Noncompliant with industry regulations such as HIPAA or FISMA

- Noncompliant with company standards

- Noncompliant with contract terms (i.e., breaching contract obligations)

A contract compliance audit focuses first and foremost on identifying areas of non-compliance so you can improve contract compliance. That alone is a reason to perform regular contract compliance audits.

SOURCE: PKF Texas via YouTube

Better Understand Contract Obligations

It’s important that you have a handle on all your contractual obligations and deliverables, as well as the obligations of your contract partners. You need to know what you’re obligated to do, both individually and in total, to best fulfill those obligations – and ensure that your partners live up to their end of the deals, too. A contract compliance audit will also help you better understand the legal, compliance, and other obligations resulting from your contracts. Technology such as contract management software makes it automated and easy to track all contractual obligations.

Better Understand Contract Options

What do you do if a contract isn’t fulfilled? What are your rights? A contract compliance review can help you better understand your options when you encounter a non-compliant partner, whether late fees, arbitration, litigation, or something else.

Improve Trust with Business Partners

A contract compliance audit provides transparency for all your business agreements. A collaborative audit between you and your contract partners identifies potential issues and helps improve trust between all parties involved.

Improve Billing Accuracy

Billing errors can’t be avoided, although they can be minimized. A contract compliance audit identifies current errors so you can fix them and points out areas where billing accuracy can be improved. It’s important to catch errors in your own contract billing and the billings from your contract partners.

Identify Cost Savings

Use a contract audit to identify contracts in which you’re paying more than agreed to. Sometimes your accounting department automatically pays bills without verifying their accuracy. A contract audit can fix that and save you money in the long term.

Improve Contract Management Process

Finally, a contract compliance audit can provide insight into your entire contract management process. This is true even if you use contract lifecycle management (CLM) software, such as that offered by Contract Logix. The CLM software contains all the information you need for a quick and thorough audit and is easy to reconfigure to improve efficiency and effectiveness.

Let Contract Logix Help Smooth the Contract Compliance Audit Process

The best way to prepare for a contract compliance audit is with CLM software from Contract Logix. Our CLM Platform automates the entire contract management process from start to finish, minimizing noncompliance risks and providing c data for use in a compliance audit. Contract Logix CLM software also speeds up your contract workflow, reduces errors, and reduces your contract-related costs. It’s the perfect solution to improve compliance and create a more streamlined contract management process for your organization.

Contact Contract Logix today to learn more about the contract compliance audit process.